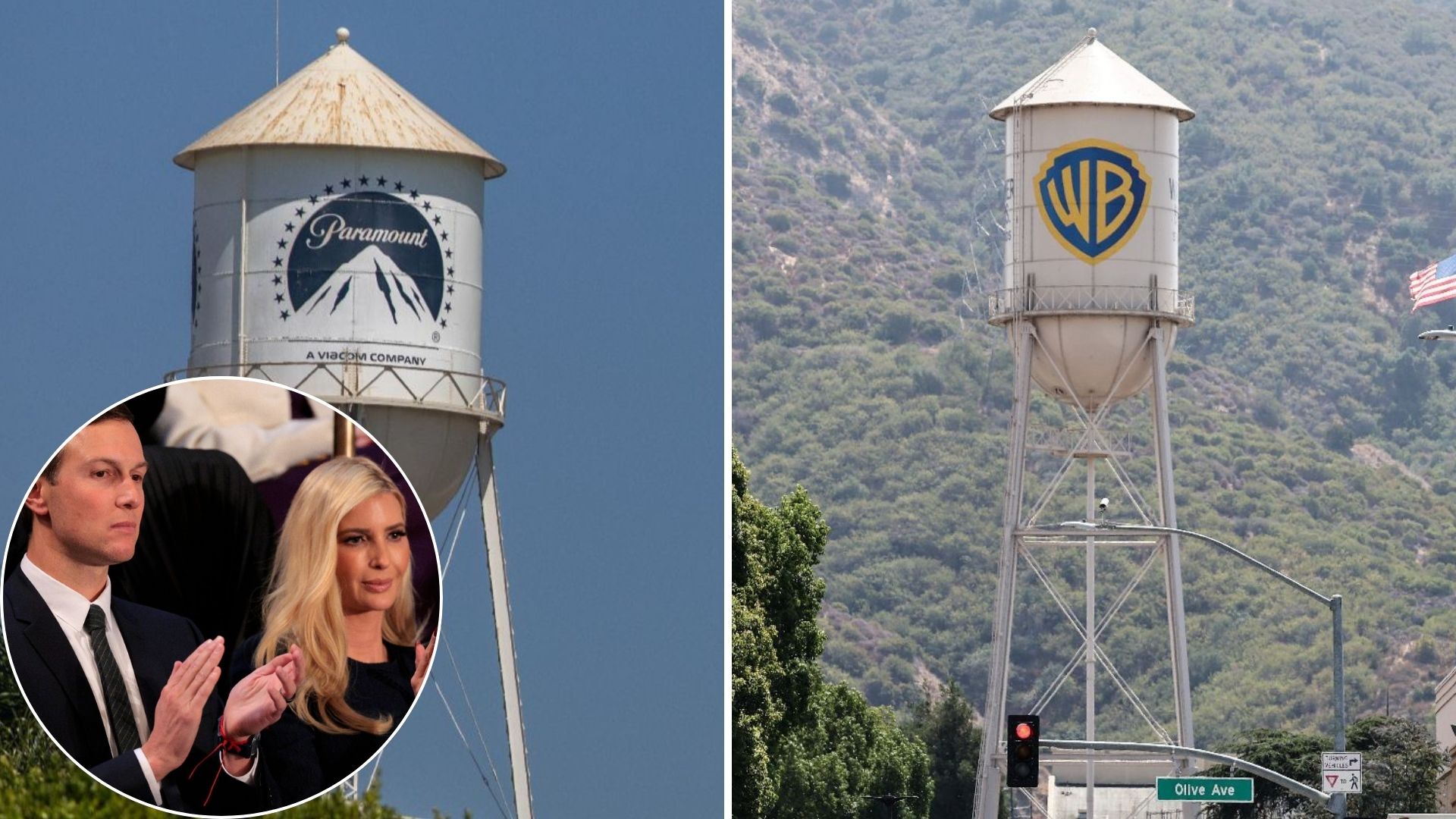

A few hours after Paramount unveiled its hostile bid to take over Warner Bros. Discovery — itself coming just days after Netflix's surprise announcement that it intended to buy Warner Bros. and HBO — a new twist emerged: Jared Kushner, the son-in-law of Donald Trump, is involved in Paramount's effort to seize control of Warner Bros., HBO and also CNN, a network frequently criticized by Trump. According to the New York Times, Kushner's private equity firm, Affinity Partners, is among the investors supporting Paramount's offer, adding an unexpected political dimension to an already high-stakes corporate battle.

Paramount returned to the table with its hostile bid only after its first offer for Warner Bros. Discovery had been rejected as too low, and it was able to raise its price thanks to a wave of external financing. In regulatory filings, the company said that Larry Ellison, the father of chief executive David Ellison, together with the private equity firm RedBird Capital Partners, had committed to backstop the 40 billion dollars in cash needed for the new offer. Paramount also lined up a group of additional investors to offload part of that commitment, including Jared Kushner's private equity firm Affinity Partners, as well as sovereign wealth funds from Saudi Arabia, Qatar and Abu Dhabi, whose money would help fund the takeover of Warner Bros. Discovery and its crown jewels, from HBO to CNN.

On 5 December, Netflix announced a 72 billion dollar deal to buy Warner Bros. Discovery's film and TV studios and its HBO Max streaming service, a takeover that would fold some of Hollywood's most valuable assets into the Netflix empire. Trump quickly cast doubt on the transaction, warning that the merger «could be a problem» because of Netflix's market share, saying he would be «involved» in the review and signalling that his administration viewed the deal with «heavy skepticism» on antitrust grounds. A few days later, Paramount escalated the fight: after an initial bid of around 60 billion dollars, at just under 24 dollars per share, had been rejected by Warner Bros. Discovery as too low, the company returned with a hostile all-cash offer worth 108.4 billion dollars, or 30 dollars per share, for the entire group, including CNN and the traditional TV networks. That new proposal is roughly 48.4 billion dollars higher than Paramount's first approach and about 36.4 billion more than Netflix's 72 billion dollar bid.

Conservative-leaning moguls

People close to Trump are now circling not just legacy TV brands but also the biggest social platform of the moment. With Jared Kushner's Affinity Partners helping to finance Paramount's hostile bid for Warner Bros. Discovery, a Trump family vehicle could end up with a stake in Warner Bros., HBO and CNN, a network the president routinely attacks. At the same time, Trump has said he is lining up a «very wealthy» group of buyers to take over TikTok's US operations, and has publicly name-checked conservative-leaning moguls such as Rupert and Lachlan Murdoch, Michael Dell and Larry Ellison among the potential investors. Taken together, these moves mean that some of the most coveted news and entertainment assets in the country — from cable channels to a dominant short-video app — are being targeted by financiers and tech billionaires who are either directly tied to the Trump family or closely aligned with the president politically.

This content was created with the help of AI.