UAE-Linked Firm Acquired 49% of Trump Family Crypto Company Days Before Second Inauguration

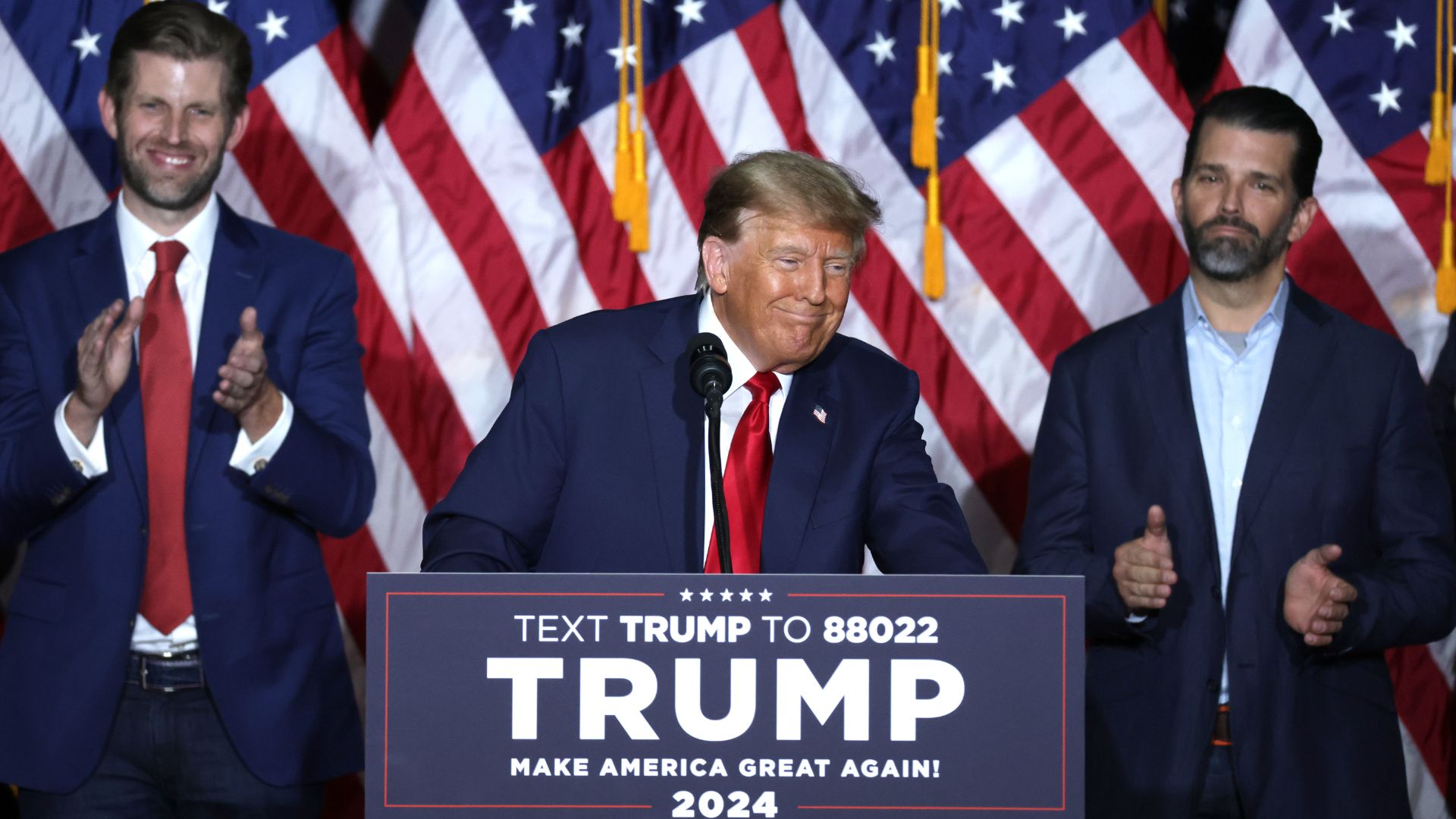

A firm linked to the United Arab Emirates acquired a 49% stake in World Liberty Financial, the Trump family's cryptocurrency company, just days before President Donald Trump's second inauguration, according to reporting by The Wall Street Journal. The transaction, valued at roughly $500 million, was signed by Eric Trump and granted near-minority ownership to investors connected to Sheikh Tahnoon bin Zayed Al Nahyan, a senior Emirati royal, national security adviser, and overseer of major sovereign wealth funds. The timing of the deal has drawn attention in Washington and beyond, given the proximity to Trump's return to office and the involvement of a foreign government-linked network in a company tied to the president's family. Company documents cited by the Journal indicate that a substantial portion of the funds was paid upfront, with proceeds distributed to Trump family entities and to entities linked to Steve Witkoff, a longtime Trump associate and current US special envoy to the Middle East.

World Liberty Financial has described the transaction as a purely commercial decision driven by growth ambitions rather than politics. A spokesperson for the company, David Wachsman, said the investment reflected confidence in the firm's trajectory and denied any connection to US policy decisions. «We made the deal in question because we strongly believe that it was what was best for our company as we continue to grow,» Wachsman said. He also rejected suggestions that the investment was tied to diplomatic or regulatory considerations, particularly amid reporting that Sheikh Tahnoon has sought greater US access to advanced artificial intelligence chips. «Any claim that this deal had anything to do with the administration's actions on chips is 100% false,» Wachsman said, adding that the company does not seek or receive special treatment and operates under the same rules as other firms in the sector.

«This is corruption, plain and simple. Congress needs to grow a spine and put a stop to Trump's crypto corruption.»

-Senator Elizabeth Warren

The White House has also pushed back against allegations of conflicts of interest stemming from the deal, emphasising that President Trump's assets are held in a trust managed by his children. In a statement, White House spokesperson Anna Kelly said: «President Trump only acts in the best interests of the American public … There are no conflicts of interest.»

Administration officials have further noted that Trump and Witkoff are listed as emeritus co-founders and are no longer involved in the company's operations, while their sons continue to promote the venture internationally. World Liberty Financial has confirmed that two senior executives from companies backed by Sheikh Tahnoon joined its board as part of the agreement, a move it characterises as standard governance practice following a major capital infusion.

Despite those assurances, the transaction has prompted sharp criticism from Democratic lawmakers and former officials, who argue that the deal blurs the line between public office and private gain. Senator Elizabeth Warren described the arrangement in stark terms, writing:

«This is corruption, plain and simple. Congress needs to grow a spine and put a stop to Trump's crypto corruption.»

Other Democrats have echoed those concerns, warning that the involvement of foreign government-linked investors in a company associated with the family of a sitting president is unprecedented in modern US politics. Critics say the deal risks undermining public trust at a moment when the administration is actively promoting the expansion of the US cryptocurrency sector, while supporters counter that similar business activities by presidential families have occurred in past administrations, albeit without comparable foreign ownership stakes.

Created by humans, assisted by AI.